In November 2025, I wrote a couple of news articles and made some Facebook Posts about recent New England North Dakota City Council meetings where a City Councilman had created a list of about 130 residents with alleged violations of grass too tall, weeds, junk, boats, campers, trailers, vehicles parked in their yards.

I then began receiving emails and messages from friends and family members of elderly people who lived in New England, who were concerned about what was going to happen to them. Several of these messages, sent from more than one person, were regarding a man in his seventies who lived down the street from me named “Ray”.

The first person who contacted me about Ray, said that Ray was a proud and private person, who did not want anyone to know about his problems. This person explained that Ray’s health was bad, he was not able-bodied, and that he was going to have difficulty remedying the City of New England’s alleged violations.

The second person who contacted me about Ray a few weeks later, said, “Did you hear what happened to Ray? Ray had his house sold out from under him, without his knowledge.”

Did I Hear What Happened To Ray?

No, I had not heard what happened to Ray. How did his house get sold out from under him without his knowledge? Is this true? Did this really happen? If this was because of his failure to pay his Property Taxes, surely the Tax Assessor sent him several Notices?

I didn’t want to believe that this was true. Because if this was true, this meant that this could happen to me, this could happen to any of us in New England. I chose to believe that the Hettinger County Tax Assessor must have sent him plenty of Notices that his Property Taxes were Delinquent.

I wanted to talk to Ray and find out what had happened to him, to find out if this was true or not. But just like the New England residents that never come to the City Council meetings, I chose to believe that nothing terribly bad was happening, no injustice was occurring, I didn’t want to get involved with other people’s problems, and I was busy with my own problems.

Meeting Ray And Hearing It From Him

Yesterday, Saturday morning when it was -5 degrees Fahrenheit outside, I went to the New England Post Office which was already closed for the day, to check my PO Box. From inside the Post Office, I saw Ray drive up and get out of his vehicle. When Ray came inside, I introduced myself to him. By this time, I had already exchanged a couple of email messages with Ray regarding the list of alleged property violations in New England.

Ray who is in his 70s explained to me, that due to his disabilities, his health problems, and the amount of medication that he is taking, he is only out-and-about for about two hours each day. In addition to his knee replacement, hip replacement, diminished lung capacity due to asbestos exposure, a heart aneurysm, a neurological disorder that causes his eyelids to involuntarily close, he is often sick. He told me a little about his military service. Then about some of his legal disputes with the City of New England.

Ray explained that Yes, it was true that his house had been sold without his knowledge. One day in November, a man named “Marcelles” knocked on his door and announced, “I own your house now. I bought your house for Delinquent Taxes.” This was a complete surprise to Ray.

By this time, talking with Ray, I could understand how Ray could have been unaware that his house was going to be taken by Hettinger County for non-payment of Delinquent Property Taxes. Due to his age, several different disabilities, several different health problems, being sick on top of that, with no one checking that he is tracking and current with his Bills, I absolutely understand how Ray could have been unaware of a Delinquent Property Tax Foreclosure by Hettinger County.

Was Ray Notified Of Delinquent Taxes?

It is possible that Ray did not receive Delinquent Property Tax Notices via regular US Postal Service Mail or Certified US Postal Service Mail because the New England Post Office was completely closed from May through July in 2025 due to a roof leak.

Is There Anything That Can Be Done About This Now?

In my opinion, most Attorneys and most Tax Assessors may never have to deal with the Legal Process of “Redemption” in their career. Below is an Artificial Intelligence explanation of Redemption in North Dakota, but the actual North Dakota Century Code is more difficult to read and interpret:

“AI Overview

In North Dakota, you can get your property back after it has been sold for delinquent taxes through a process called redemption, provided you act within the specific redemption period. The exact process and timeline depend on whether a tax lien was sold or if the county foreclosed and issued a tax deed.

Redemption Period

In North Dakota, the process does not typically involve the sale of tax liens to private individuals, but rather the property is foreclosed upon by the county and then sold at auction.

- Before the County Sale: You can pay the delinquent taxes, penalties, interest, and costs to the county treasurer at any time up until the date of the annual tax sale (usually the third Tuesday in November). This stops the foreclosure process.

- After the County Sale (Right of Redemption): North Dakota law provides a redemption period, which generally allows the original owner to reclaim the property after the tax sale has occurred.

- For most properties, the redemption period is one year from the date of the sheriff’s sale.

- For agricultural land, the redemption period is longer, generally one year after the foreclosure complaint is filed or 60 days after the sale, whichever is later.

Steps to Reclaim Your Property

- Contact Your Local County Treasurer/Auditor: This is the most crucial first step. Contact the county office to determine the exact amount required to redeem your property. The amount will include the winning bid amount at the auction, plus interest (which is typically an annual rate of 12%, charged quarterly), penalties, and any additional fees or costs incurred by the purchaser.

- Determine Who to Pay: The payment can generally be made to the purchaser of the property at the tax sale or to the officer who conducted the sale (the sheriff or county auditor).

- Pay the Full Redemption Amount: The full amount must typically be paid at once using cash or certified funds. Partial payments generally do not qualify for redemption.

- Obtain a Certificate of Redemption: After payment, the county office will issue a certificate of redemption or a similar official document. This is your official proof that the tax lien has been satisfied and ownership rights are restored. The redemption cancels the tax lien and prevents the purchaser from receiving the deed to your property.

Important Considerations

- Act Quickly: The cost to redeem your property increases as more interest and fees accrue over time.

- Consult an Attorney: Tax laws can be complex. Consulting an experienced real estate attorney in North Dakota is highly recommended to ensure all procedures are followed correctly, especially if there are any disputes over the amount owed or if the situation is complex. You can contact the North Dakota Office of State Tax Commissioner for general guidance.”

What Steps Are Being Taken Now

I have contacted an Officer of the American Legion Post in New England. This Officer is going to contact the American Legion Post in Dickinson, and probably elsewhere. There will be an attempt to raise funds. Hopefully, an account will be created at a local Bank where donations can be received.

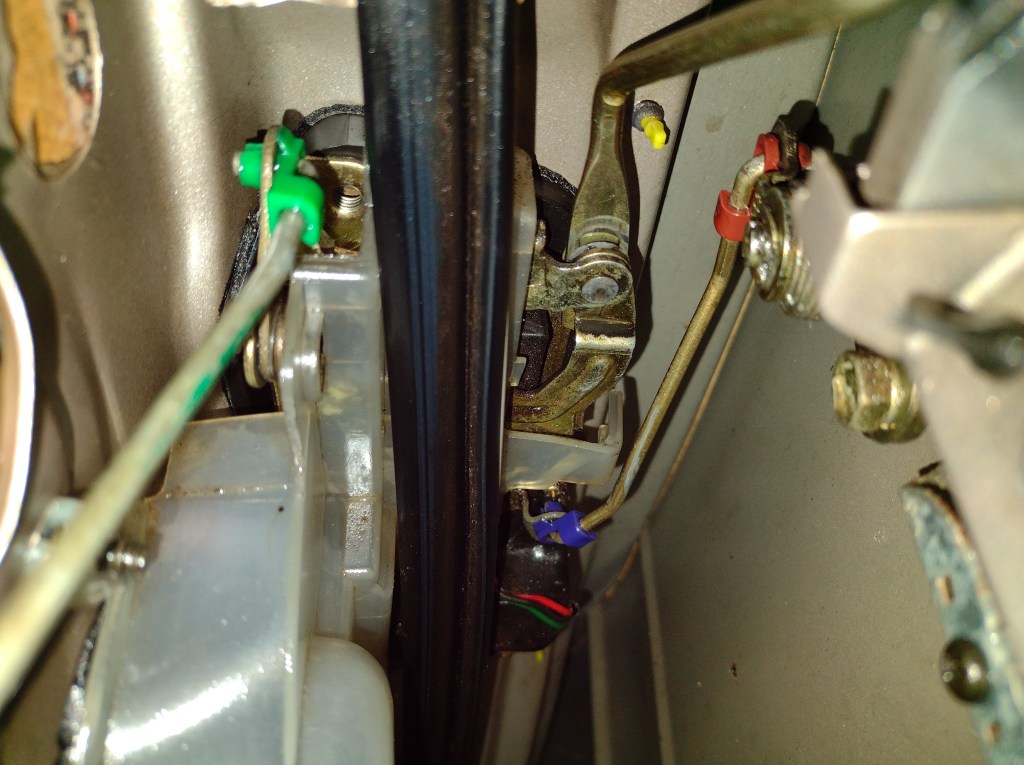

Ray owns a 2008 Special Edition Triumph motorcycle with only 5,400 miles on it, that is in very good condition. Ray will sell this motorcycle in order to have some of the money to pay for his house Redemption.

A Go-Fund-Me Account has been created https://gofund.me/74c39dc11

Is This A Case Of Stolen Valor, If Not Why Isn’t The VA Helping?

No, this is not a case or ploy of “Stolen Valor” by someone who is not a US Military Veteran. I know and have recently met with the woman who drives and assists Ray to some of his medical appointments at the Veterans Administration clinics in Dickinson, the same as she does with her own father. Also, I have looked at some of Ray’s letters from the Veterans Administration regarding his upcoming scheduled medical appointments for heart procedures.

I believe that both the Veterans Administration and Adult Protective Services of North Dakota probably should offer some assistance, such as Legal Services, Legal Assistance, Legal Advocacy, Financial Services, Financial Fiduciary Services.

A Little Personal Information About Ray

Ray enlisted in the United States Marine Corps in 1973. After completing Basic Training he was a Private First Class stationed at Oak Harbor Washington Naval Base performing security. Later Ray became a SCUBA Diver and Water Safety Survival Instructor Trainer for the US Navy.

After Ray’s military service he became married and had two sons. When his sons were very young, he raised them as a single-father. Ray later re-married. In the early 2000s Ray’s wife was medical-air-flighted to Billings for emergency surgery to replace four heart valves. Even after what health insurance covered, the medical bills amounted to several hundred thousand dollars. His wife never completely recovered and continued to require daily medical care for the next fifteen years until her death.

Ray worked as an accountant, auditor, computer tech & IT administrator, mechanic, and truck driver. In 2016 Ray’s physical health began to decline. In 2022 Ray had his hip replaced. In 2023 he had his knee replaced. Later in 2023 Ray had a Thorasic Aortic Aneurysm. His live-in girlfriend moved out because she had to return to her family back East.

Currently at this time, Ray is able to perform daily tasks such as washing dishes, taking the garbage out, preparing something to eat, driving to the local in-town store, as long as everything can be completed within a few hours. Due to pain, feeling sick, feeling exhausted, effects of many medications that he is taking, he can’t continue with tasks for more than several hours each day.